The Income Tax Department has also launched its one-time password (OTP)-based e-filling verification system on 13th July 2015, which would end the requirement for sending a hard copy through post as part of the acknowledgement process to its office in Bangalore. The Income Tax Department has also launched its one-time password (OTP)-based e-filling verification system on 13th July 2015, which would end the requirement for sending a hard copy through post as part of the acknowledgement process to its office in Bangalore.The facility can be accessed using Internet banking, Aadhaar Number, ATM and Email. According to rules notified in this regard by the Central Board of Direct Taxes (CBDT), any taxpayer whose income is ₹5 lakh or below per annum and has no refund claims can straightaway generate the electronic verification code (EVC) for e-filing and validating his/ her Income Tax Return (ITR) through registered mobile number and e-mail id with the department. Want to file Income Tax Return, Go directly to Income Tax Department Website for e-filing |

M. Manohar |

The Government this year is trying to simplify the tax filing process and at the same time working on measures to check tax evasion. Accordingly some changes have been made into Income Tax Returns Forms and some new forms have been notified on 23rd June 2015. As per the new norms, an individual or HUF who does not have capital gains, income from business/ profession or foreign asset/ foreign income can file a shorter version of ITR2, i.e. ITR 2A. The time limit for filing these returns is extended up to 31 August 2015. The Government this year is trying to simplify the tax filing process and at the same time working on measures to check tax evasion. Accordingly some changes have been made into Income Tax Returns Forms and some new forms have been notified on 23rd June 2015. As per the new norms, an individual or HUF who does not have capital gains, income from business/ profession or foreign asset/ foreign income can file a shorter version of ITR2, i.e. ITR 2A. The time limit for filing these returns is extended up to 31 August 2015. Additionally the following changes have been made in tax filing:

|

M. Manohar |

The Key Highlights of the Interim India Budget 2019-20 presented by the Finance Minister Shri Piyush Goyal (in place of Shri Arun Jaitely) on 1st February 2019 are:

|

M. Manohar |

The <a href="http://www.bankbazaar.com">Bank Bazaar</a> has published data based on 16 Lakhs Applications received through the portal in the Year 2018. The Bengalurueans have taken the top positions both in Personal Loan (Maximum 47 Lakhs) and Vehicle Loan (Maximum 49.9 Lakhs). The <a href="http://www.bankbazaar.com">Bank Bazaar</a> has published data based on 16 Lakhs Applications received through the portal in the Year 2018. The Bengalurueans have taken the top positions both in Personal Loan (Maximum 47 Lakhs) and Vehicle Loan (Maximum 49.9 Lakhs). Top Personal Loan - Bengaluru - 47 Lakhs, Mumbai - 40 Lakhs, Kolkata - 30 Lakhs Top Vehicle Loan - Bengaluru - 49.9 Lakhs, Chennai - 46.8 Lakhs, Delhi 21.8 Lakhs |

M. Manohar |

There is nothing in the Income Tax Act to prevent a salaried person from claiming exemption under Section 10(13A) on the basis of rent paid to a close relative. However, the Section 143(2) empowers the IT Officials to examine the genuineness of the rent payments. There is nothing in the Income Tax Act to prevent a salaried person from claiming exemption under Section 10(13A) on the basis of rent paid to a close relative. However, the Section 143(2) empowers the IT Officials to examine the genuineness of the rent payments. When ever, such a claim is noticed by Income Tax Officials, they look at it with suspicion and may further probe into details. It is therefore recommended if you happen to claim HRA Exemption for rent paid to a close relative to comply the following:

|

Raginee |

The key points relating to the Cash Transaction Charges are as given : The key points relating to the Cash Transaction Charges are as given :

|

M. Manohar |

Economic growth is an increase in the production and consumption of goods and services. It entails increasing population and/or per capita consumption in comparison to previous year. It is generally indicated by percentage increase in GDP. Economic growth is an increase in the production and consumption of goods and services. It entails increasing population and/or per capita consumption in comparison to previous year. It is generally indicated by percentage increase in GDP. As the economy is defined as the state of a country or region in terms of the production and consumption of goods and services and the supply of money, any upward change in any of the above can be termed as economic growth. |

M. Manohar |

The economic systems all across the world fall into one of four main categories: Traditional Economy, Market Economy, Command Economy and Mixed Economy; however, there are unlimited variations of each type. An economic system generally covers the aspects such as what to produce, how to produce it and for whom to produced it. The economic systems all across the world fall into one of four main categories: Traditional Economy, Market Economy, Command Economy and Mixed Economy; however, there are unlimited variations of each type. An economic system generally covers the aspects such as what to produce, how to produce it and for whom to produced it.

|

M. Manohar |

Prime Minister Shri Narendra Modi has launched Gold Sovereign Bond scheme on 5th November 2015. This scheme can be utilized for buying gold in paper form duly guaranteed by the Government. Application forms for scheme can be submitted to the Banks from 5th to 20th November 2015. It is confirmed by RBI that saving bank rate interest shall be payable on the payments made by the applicants until issue of bonds. The bonds shall be issued on 26th November 2015 in the units of 1 gram gold. Prime Minister Shri Narendra Modi has launched Gold Sovereign Bond scheme on 5th November 2015. This scheme can be utilized for buying gold in paper form duly guaranteed by the Government. Application forms for scheme can be submitted to the Banks from 5th to 20th November 2015. It is confirmed by RBI that saving bank rate interest shall be payable on the payments made by the applicants until issue of bonds. The bonds shall be issued on 26th November 2015 in the units of 1 gram gold.The tenure of the Gold Bond shall be 8 years with a provision for exit after 5 years. Investors will be compensated at a fixed rate of 2.75 percent per annum payable semi-annually on the initial value of investment. |

Swati Arora |

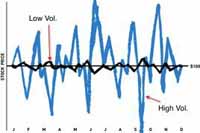

You can easily calculate historical volatility using MS Excel Worksheet. All you need to do is to put down close prices of a share for the last six months in a column of the excel sheet. Calculate the daily returns, that is, use "LN" (Natural Log) function in excel. Use the formula LN(today’s close price / yesterday’s close price) in the next column for calculating daily returns for all the days. Go to the end of the second column (after the last value) and use the excel function "STDEV" (available under statistical formulas) to calculate the Standard Deviation of returns computed as above. The calculated standard deviation expressed as percentage is the historical volatility of the share for the six months period. You can easily calculate historical volatility using MS Excel Worksheet. All you need to do is to put down close prices of a share for the last six months in a column of the excel sheet. Calculate the daily returns, that is, use "LN" (Natural Log) function in excel. Use the formula LN(today’s close price / yesterday’s close price) in the next column for calculating daily returns for all the days. Go to the end of the second column (after the last value) and use the excel function "STDEV" (available under statistical formulas) to calculate the Standard Deviation of returns computed as above. The calculated standard deviation expressed as percentage is the historical volatility of the share for the six months period. |

Sanjeev Jain |

10 Trade unions (CITU, INTUC, AITUC, Hind Mazdoor Sabha, AIUTUC, TUCC, SEWA, AICCTU, UTUC and LPF) had gone ahead with the Bharat Bandh on 2nd September 2015 when their talks with the Government have not resulted in their demands being accepted in totality. Their key demands out of 12 Points Charter based on published news are given below: 10 Trade unions (CITU, INTUC, AITUC, Hind Mazdoor Sabha, AIUTUC, TUCC, SEWA, AICCTU, UTUC and LPF) had gone ahead with the Bharat Bandh on 2nd September 2015 when their talks with the Government have not resulted in their demands being accepted in totality. Their key demands out of 12 Points Charter based on published news are given below:

Responding to demands, the Government had circulated a note explaining that it is already working on seven of the demands put ahead by the Trade Unions which include amendments to Minimum Wages Act, Contract Labour Act and providing Universal Society Security. |

Pooja Sharma |

Profits earned by sale of equity shares are classified into two categories: Short Term Capital Gain and Long Term Capital Gain. Short Term Capital Gain is realized when you sell the shares within 12 months period from buying date. If the shares are sold after more than 12 months holding period than the profit is termed as Long Term Capital Gain. If the sale of share is done only through a stock exchange (includes listed stock through a broking firm), Security Transaction Tax is levied and this sale is also known as STT Paid. Profits earned by sale of equity shares are classified into two categories: Short Term Capital Gain and Long Term Capital Gain. Short Term Capital Gain is realized when you sell the shares within 12 months period from buying date. If the shares are sold after more than 12 months holding period than the profit is termed as Long Term Capital Gain. If the sale of share is done only through a stock exchange (includes listed stock through a broking firm), Security Transaction Tax is levied and this sale is also known as STT Paid.As of now, STT Paid Long Term Capital Gains are not taxed. However, Short Term Capital Gains from shares are chargeable @ 15% flat. In case your total annual income (excluding short term capital gain) is less than 2,50,000/-. Then short term gain is only payable on the amount by which total income including short term gains is exceeding the above limit. Example: Income without Short Term Gain: 2,25,000/-Short Term Capital Losses are allowed to be carried forward. Means, if you have incurred loss, then report in Income Tax Return this year, so that it can be adjusted against future profits and saving of the tax. Long Term Capital Loss (STT Paid) can not be carried forward. |

M. Manohar |